Auctus Fora

Highlights

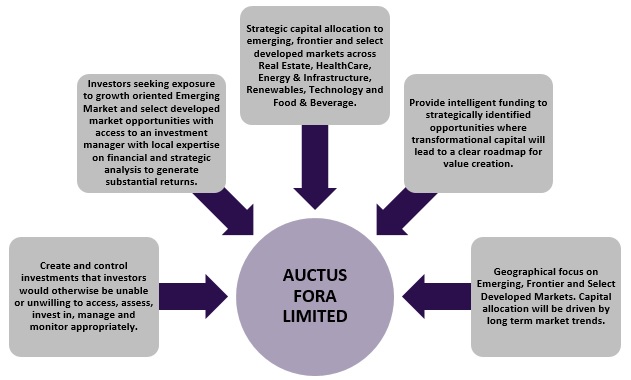

Investment Framework

Performance Objective- To consistently achieve long term performance in the chosen sectors.

- Auctus Fora Management believes that the innovative investment approach and cycle timing should enable returns of 2 to 3 times invested capital on individual investments with medium to long term exits.

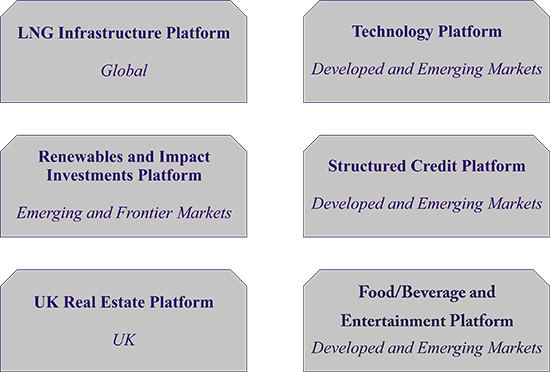

- Auctus Fora’s evolvement since August 2014 is measureable and significant. We have been successful in identifying and finalizing SIX sub-strategies, tailor made for and on behalf of our institutional and family office partners. Each sub-strategy includes a strategic partner of global recognition and sector specific operating team with critical subject matter expertise.

- Auctus Fora selectively invests in outstanding opportunities alongside proven Tier 1 institutional Funds and Family Investment Office; leveraging premier transactions. We capitalise on exposure to highly attractive investments otherwise not available to private investors.

- Auctus Fora also actively participates in co-investments due to more appealing returns. A total of 85% of co-investment transactions have out performed traditional private equity funds in the last 5 years according to a 2014 March survey by private equity data provider Preqin.

- Appetite for private equity co investments is outstripping supply with more than 36% of private equity managers proactively seeking co investment opportunities. As co investments have shorter turnaround time for investment decisions, Auctus Fora co-investment process is designed to streamline the investment assessment and to provide effective and efficient analysis for investment decision making.

- Investments may take the form of ordinary equity, preferred equity, convertible securities or debt.

- Investments will be made through special purpose vehicles (SPVs) wholly owned by the Investment Platform.

Strategy and Sectors

Track Record

PROJECT |

DESCRIPTION |

INDUSTRY |

MARKET |

TERM |

CAPITAL |

RETURN |

|---|---|---|---|---|---|---|

| ALPHA | DEVELOPMENT CAPITAL PROJECT / ASSET LEVEL |

REAL ESTATE | DEVELOPED | 26 MONTHS | PREFERRED EQUITY: $12.5 M MEZZANINE: $6.98 M |

IRR: 27.4% IRR: 20.0% |

| BETA | FINANCIAL INVESTOR BUY OUT PROJECT / ASSET LEVEL |

REAL ESTATE | EMERGING | 42 MONTHS | EQUITY & PREFERRED EQUITY CUMMULATIVE: $38.2 M |

IRR: 36.8% CoC: 2.52x |

| DELTA | SIGNIFICANT MINORITY IN GROWTH STAGE COMPANY LEVEL |

SOCIAL INFRASTRUCTURE EDUCATION / HEALTHCARE |

EMERGING | 45 MONTHS | EQUITY: $8 M | IRR: 40.3% CoC: 3.3x |

| GAMMA | DISTRESSED TAKEOVER |

FINANCIAL SERVICES |

FRONTIER | 30 MONTHS | NAV: $2.1 M | CURRENT NAV: > 100% |

| KAPPA | DEVELOPMENT CAPITAL PROJECT / ASSET LEVEL |

SOCIAL INFRASTRUCTURE MEDICAL SERVICES |

EMERGING | 48 MONTHS | EQUITY: $6.5 M | IRR: 32% CoC: 3x |

| OMEGA | JV BUYOUT | INDUSTRIAL TRADING |

DEVELOPED | 36 MONTHS | EQUITY: $2 M | IRR: 44% |

| SIGMA | GROWTH CAPITAL ACQUISITION |

RESOURCES MINIG |

DEVELOPED | 24 MONTHS | EQUITY: $5 M | NAV: > 300% (IPO EXIT) |